Andorra’s Banks Shake Off BPA Crisis Hangover

The BPA crisis aftermath Andorra marked a turning point for the country’s financial sector. While the scandals severely hurt the reputation and trust, Andorra banking sector resilience is steadily being rebuilt through reforms, legal actions, and increased transparency.

What the Crisis Revealed

- In March 2015, FinCEN (the U.S. Treasury’s Financial Crimes Enforcement Network) labelled Banca Privada d’Andorra (BPA) a “financial institution of primary concern” over money laundering allegations. This triggered severe regulatory action, expropriation by the Andorran authorities, and the restructuring of BPA.

- BPA and its subsidiaries were placed under state supervision, and a “good bank”—Vall Banc—was created to assume the non-toxic assets. Meanwhile, toxic or problematic parts were separated.

- The timeline shows that BPA was not given prior notice before FinCEN’s public designation, and was not given an opportunity to respond beforehand.

Reforms & Regulatory Changes

- After the scandal, Andorra financial reforms were introduced to strengthen oversight of the banking system. These reforms aimed at aligning local banking rules with international expectations.

- Regulations concerning anti-money laundering were tightened, and the financial behaviour of banks came under closer scrutiny.

- It also increased transparency, and Andorra has taken measures to improve its financial image internationally.

Andorran Banks Post-BPA: Stability & Trust

- While the BPA fallout Andorra banks caused reputational damage, other banks in Andorra have demonstrated stability since the reforms. Banking institutions outside BPA have adapted to the new regulatory environment.

- There are no criminal convictions confirmed, and several accusations were withdrawn.

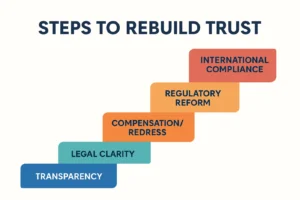

What Remains to Fully Rebuild Trust

- Rebuilding trust Andorra banking will depend on full transparency of legal proceedings and clarity about responsibility. Despite allegations, concrete legal accountability remains murky in some respects.

- Continuous compliance with international norms, especially in anti-money laundering, is emphasized. Andorra has already signed agreements for tax information exchange, and improved regulations.

FAQs

Q: Were any convictions made against BPA or its directors?

A: No. FinCEN’s accusations were later withdrawn, and no proven convictions are recorded.

Q: What happened to BPA’s non-toxic assets?

A: They were transferred to Vall Banc, to preserve those parts of the bank considered safe.

Q: Did Andorra change its financial laws after the scandal?

A: Yes. Reforms to anti-money laundering, regulation oversight, and financial transparency were introduced.

Conclusion

The Andorran banks post-BPA show signs of recovery. Through Andorra financial reforms, greater regulatory oversight, and actions toward transparency in Andorra banks, the sector is regaining stability. While the BPA crisis aftermath Andorra left a long shadow, the reforms and legal clarifications have helped move things forward.

Trust is not fully restored—but with continued focus on accountability, reform, and international compliance, the banking sector’s resilience could become a lasting strength.